What Tech Startups Need to Know About Sales Tax

You didn’t start a technology business to handle sales tax compliance. No one did. Unfortunately, though, it’s not up to you.

The Basics

Unless you do this stuff for a living like me, you probably haven’t heard of the 2018 Supreme Court sales tax decision known South Dakota vs. Wayfair. Prior to it, online businesses were considered compliant when they filed and remitted state sales tax only where they had a physical presence. Physical presence could include offices, warehouses, and employees for example. With the South Dakota vs. Wayfair decision, states could now also tax business with Economic Nexus, or remote sales. Meaning online businesses became liable for sales tax wherever their business’s sales took place. For example, a New York based company that sells trendy tube socks online, now must collect sales tax on socks it ships to a customer in Pennsylvania depending on the amount of gross sales to all PA customers.

As states rushed to enforce and refine their own sales tax regulations, most companies with physical goods began preparing to file. Companies selling software, digital goods and other intangible technology products sat tight thinking their products were exempt. Because, really, how can you tax something you can’t touch?

Well, you can. And many states did so by issuing policies that were often unique to the state, with their own additional caveats, clarifications and definitions.

How It Works in Practice

If you are selling software or digital products anywhere in the United States, it is more likely than not that you should be collecting and filing sales tax returns for multiple states. Determining your Nexus can be tricky, and each state has unique laws and guidelines, but is mainly based on two things:

1. Gross Sales: Each state has their own gross sales, and transaction thresholds. The most common is 200 transactions or $100,000 in gross sales. This means if you sell over either of these amounts you should begin filing and remitting sales tax in the state.

2. Product Definition: Depending on what value your product provides can determine how it is taxed, and unfortunately these are unique to each state.

· Digital Products – While there is no universally recognized definition of a digital product, this category usually includes audiovisual files, audio works and digital books. 30 states, and the District of Columbia, currently tax digital products in some form – shown in the map below. However, the form of product ownership (rental vs permanent ownership), payment frequency, and delivery method determine their taxability. Here’s a look at how states treat digital products based on data from Avalara.

Sales Tax on Digital Products by State

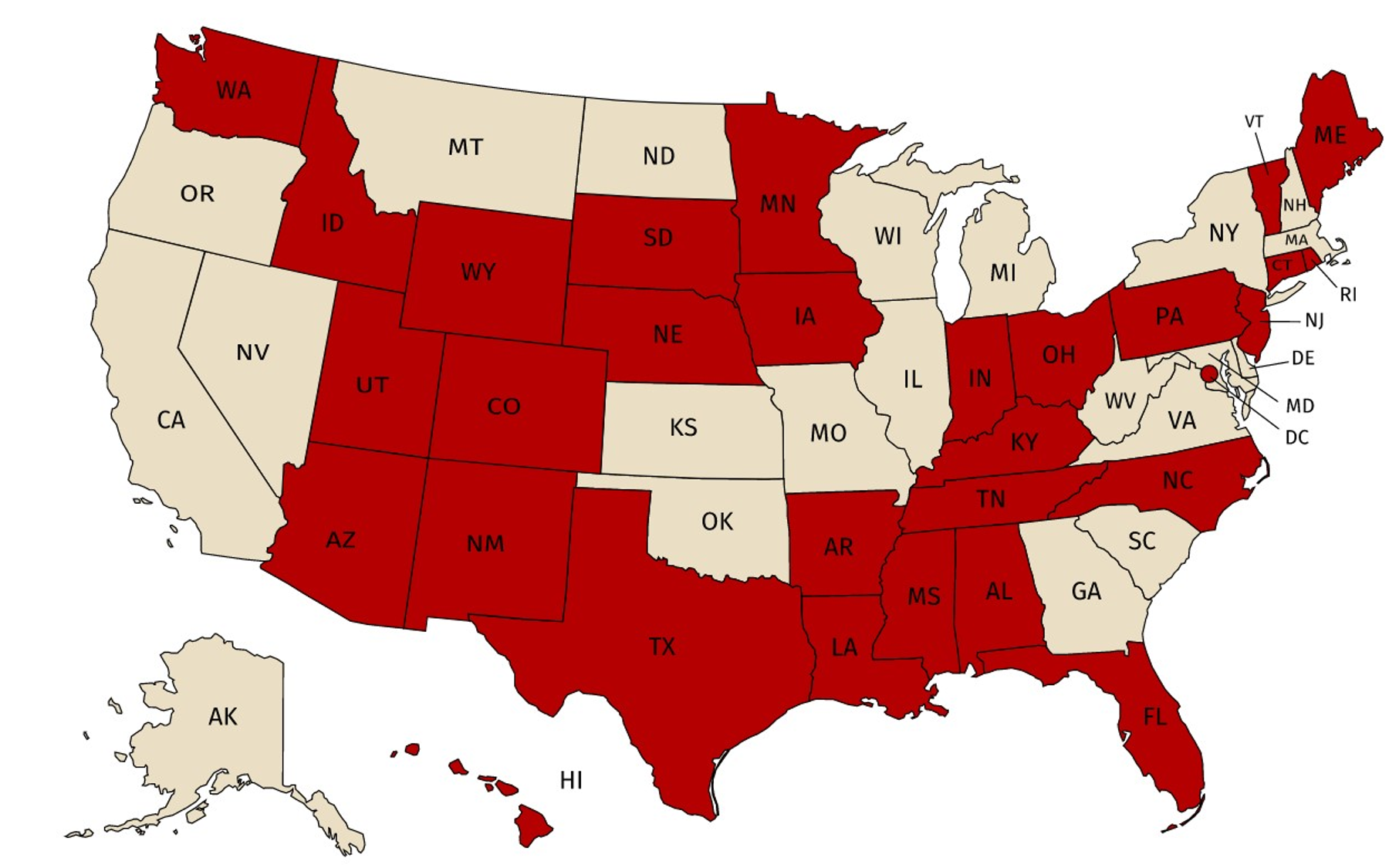

· Software – This category includes products such as Software as a Service (SAAS) or Infrastructure as a Service (IAAS). 45 states currently tax software in some form. The taxability of the software for each state can change based on use (Personal vs Business), development (Canned vs Custom) and delivery method. This map by Avalara illustrates these nuances and the various the taxability of software by state.

Sales Tax on Software by State

Deciding if your sales are taxable is a tedious, although important, analysis. Once you have recognized an Economic Nexus in a state you now are required to file and remit sales tax. This includes registering to do business in the state, obtaining a sales tax ID, and then the never-ending task of calculating, filing and paying sales tax in each period.

Sounds like a lot of work, right? It is. And, while there are many great solutions out there to help automate the sales tax filing process, they don’t completely eliminate the upfront investment. More importantly, they don’t help identify your unique software or digital product economic nexus.

Why You Can’t Ignore Sales Tax

Many start-ups choose to forgo this process, determining they are “too small” or that they “can fly under the radar”. Moreover, as we’ve seen, it’s a byzantine and tedious process that easily falls to the bottom of a founder’s to-do list. Unfortunately, this line of thinking can lead to major outlays of cash and time later down the road.

In theory, sales tax should cost companies nothing since they collect the amount from customers and remit the same amount to the state governments. However, if you get a sales tax audit, or appear on a state’s radar, authorities can require you to pay overdue sales tax since you began business in the state. Plus penalties. Plus interest. These amounts can add up quickly, and now you have lost the ability to pass this cost to the customer so it is entirely out-of-pocket.

Moreover, this scenario most often occurs when the company is under scrutiny. For example, undergoing due diligence in relation to their Series A funding round. Auditors will identify overdue sales tax from historical sales figures, and ask to see sales tax returns for these states. While this might not cancel the deal, it could lead to allocating thousands of investor dollars from your next marketing campaign to sales tax penalties. Not the best use of capital.

Lastly and most importantly, it’s the law. The libertarian in you may feel that sales taxation is theft and a suppression of a consumer-capitalist society, but it’s not up to you. Instead, suppress your libertarian ideals and get your sales tax in line. That way you can focus on what matters – adding customers to your platform and fulfilling your company’s mission.

This article was written by Samantha Golaski and can also be read here.